Billionaire bitcoin critic Howard Marks has reviewed his opinion on bitcoin, admitting it could be a legitimate currency.

At the end of July, the founder of Oaktree Capital Management wrote a 22-page memo to clients stating that digital currencies aren’t real. His position on them couldn’t be questioned. This was because he firmly stated they they weren’t real three times.

At the time he wrote:

“I’d guess these things have arisen from the intersection of (a) doubts about financial security — including the value of national currencies — that grew out of the financial crisis and (b) the comfort felt by millennials regarding all things virtual. But they’re not real.”

Furthermore, he believed people were investing in the crypto market for fear of missing out. He also claimed that digital currencies are ‘nothing but an unfounded fad or perhaps even a pyramid scheme.’ In a bid to deter people from investing in bitcoin he compared it to the tulip bubble.

However, after warning clients away from the market, it appears he’s changed his mind.

Bitcoin as a Form of Currency

In a new 11-page memo to clients Marks started by saying that his previous memo had generated the most response in the 28 years he’s been writing memos. As a result, he felt it was right to respond and reflect given the time that had passed.

He wrote:

“What bitcoin partisans have told me subsequently is that bitcoin should be thought of as a currency – a medium of exchange – not an investment asset.”

He then delves into further discussion, presenting the case for it as a currency. One of the points he mentions is that:

“For a long time currencies were backed by (and exchangeable for) gold or silver, but that’s no longer the case. The truth is, there’s nothing behind currencies these days other than their issuing government’s ‘full faith and credit.’ But what do they promise? New currencies are sometimes created out of thin air (like the euro, which wasn’t legal tender sixteen years ago), and sometimes they’re devalued.”

Marks ultimately agrees that the digital currency can be accepted for payments and as a store of value.

Reservations Still Remain

Yet, despite his new outlook on bitcoin Marks isn’t fully convinced. Even though he considers himself ‘less of a dinosaur’ regarding the currency he’s still not investing in it.

He wrote:

“I still don’t feel like putting my money into it, because I consider it a speculative bubble.”

However, he’s willing to be proven wrong about the currency. Interestingly, he sees bitcoin as being better than the dollar. This is due to the cap on the number of bitcoins issued. At present, 16.5 million coins out of the 21 million limit have been released. The cap is not expected to be reached until 2140. The dollar, though, or any other fiat currency can be issued at any time. As Marks writes this reduces ‘its purchasing power through inflation.’

He adds:

“Merely by limiting the growth of supply, bitcoin would become more valuable as other currencies devalue.”

Given the growth of bitcoin in the past nine months it remains to be seen whether Marks will eventually invest in it.

Volatility Remains

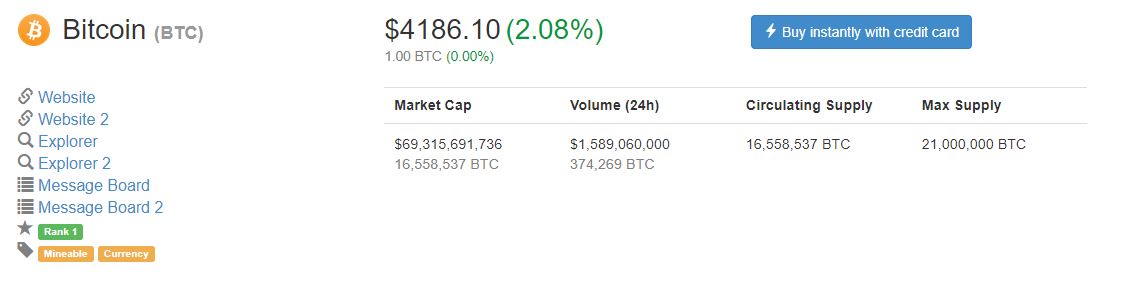

The value of bitcoin has soared to uncharted heights throughout 2017. As a result, it recently scaled the $5,000 mark. Such a milestone was monumental to the currency and those backing it. However, as of the 11th September it is trading at $4,186, according to CoinMarketCap. In a 24-hour period its value has risen by 2.09 percent, but in seven days it has fallen by 1.95 percent.

This price drop is believed to be because of China. The country recently announced the banning of initial coin offerings (ICOs) to prevent financial fraud and illegal fund-raising. As a result, the news has seen bitcoin’s value drop by nearly $1,000. On the 10th September, uncertainty over a Chinese report that the country may shut down exchanges saw bitcoin fall to $3,950. As can be seen it has slightly recovered in price.

According to the Wall Street Journal, the ban is expected to be limited to exchange-based trading and not over-the-counter transactions. The report states that China’s central bank – the People’s Bank of China (PBoC) – has drafted a draft, which will prevent Chinese platforms from providing virtual currency trading services.

It is because of situations such as this that volatility in the market remains. With people unsure of what China’s next step will be, many are selling off their coins now.

According to Yale economics professor and Nobel Prize winner Robert Shiller, the digital currency resembles that of a bubble. Known for his work on bubbles in economics, Shiller claims that bubbles are brought about by stories and not metrics.

He said:

“It’s the quality of the story that’s attracting all this interest, and it’s not necessarily sustainable.”

He added:

“The story has inspired young people and active people, and that’s what’s driving the market. It’s not fundamentals. It’s not like this is a fundamentally important thing, this bitcoin.”

Cryptocurrencies Will Remain

Of course, despite government curbs to control the digital currency market, they will remain.

This is the thinking of Mark Mobius, executive chairman of Templeton Emerging Markets. He said that the crypto market is gaining prominence because they provide a fast way to transact with.

Yet, he believes that China is ‘ahead of the game’ in stopping ICOs as there is the danger of them being used by terrorists. However, while there are attempts from governments to curb the market it’s unlikely that they will disappear anytime soon.

As another report puts it:

“A ban on crypto exchanges won’t mean the end of trading in digital currencies.”

The market is going through an interesting phase for many market watchers. As such, it remains to be seen what will happen in the weeks and months that follow. The jury is still out regarding China’s decision and while bitcoin has risen in price from the 10th, it’s still feeling an impact.

For the time being, however, Marks has given a small nod of approval toward the currency and that can only be seen as a good thing.

Featured image from Shutterstock.