|

Lucky Block |

200% up to €10,000 |

200% up to €10,000

|

|

Claim Bonus

NO CODE REQUIRED

|

|

BC.Game |

4 Bonuses Matched 270-360% |

4 Bonuses Matched 270-360%

|

|

Claim Bonus

NO CODE REQUIRED

|

|

Cloudbet |

100% Matched Deposit Bonus Of Up To 5 BTC |

100% Matched Deposit Bonus Of Up To 5 BTC

|

|

Claim Bonus

NO CODE REQUIRED

|

|

VAVE |

100% up to 1 BTC |

100% up to 1 BTC

|

|

Claim Bonus

NO CODE REQUIRED

|

|

Fairspin |

4 Bonuses Of 75% to 200% |

4 Bonuses Of 75% to 200%

|

|

Claim Bonus

NO CODE REQUIRED

|

|

Jackbit |

Anonymous Crypto Sports Betting Site |

Anonymous Crypto Sports Betting Site

|

|

Claim Bonus

NO CODE REQUIRED

|

|

Winz.io |

100% Deposit Bonus up to $500 + $20 Free Bet |

100% Deposit Bonus up to $500 + $20 Free Bet

|

|

Claim Bonus

NO CODE REQUIRED

|

|

BetOnline |

50% Deposit Bonus up to $1,000 |

50% Deposit Bonus up to $1,000

|

|

Claim Bonus

NO CODE REQUIRED

|

|

Thunderpick |

100% up to $500 |

100% up to $500

|

|

Claim Bonus

NO CODE REQUIRED

|

|

Rabona |

First Deposit Bonus Up To $750 |

First Deposit Bonus Up To $750

|

|

Claim Bonus

NO CODE REQUIRED

|

The 10 Best Bitcoin Betting Sites for 2024

Before we get into our comprehensive reviews, check out our list of the best Bitcoin betting sites for 2024:

- Lucky Block Sportsbook – Overall Best Bitcoin Betting Site 2024

- BC.Game – Dual Crypto Sportsbook and Casino With 150+ Coins Accepted

- Cloudbet – One of the Original Bitcoin Sportsbooks to Enter the Market

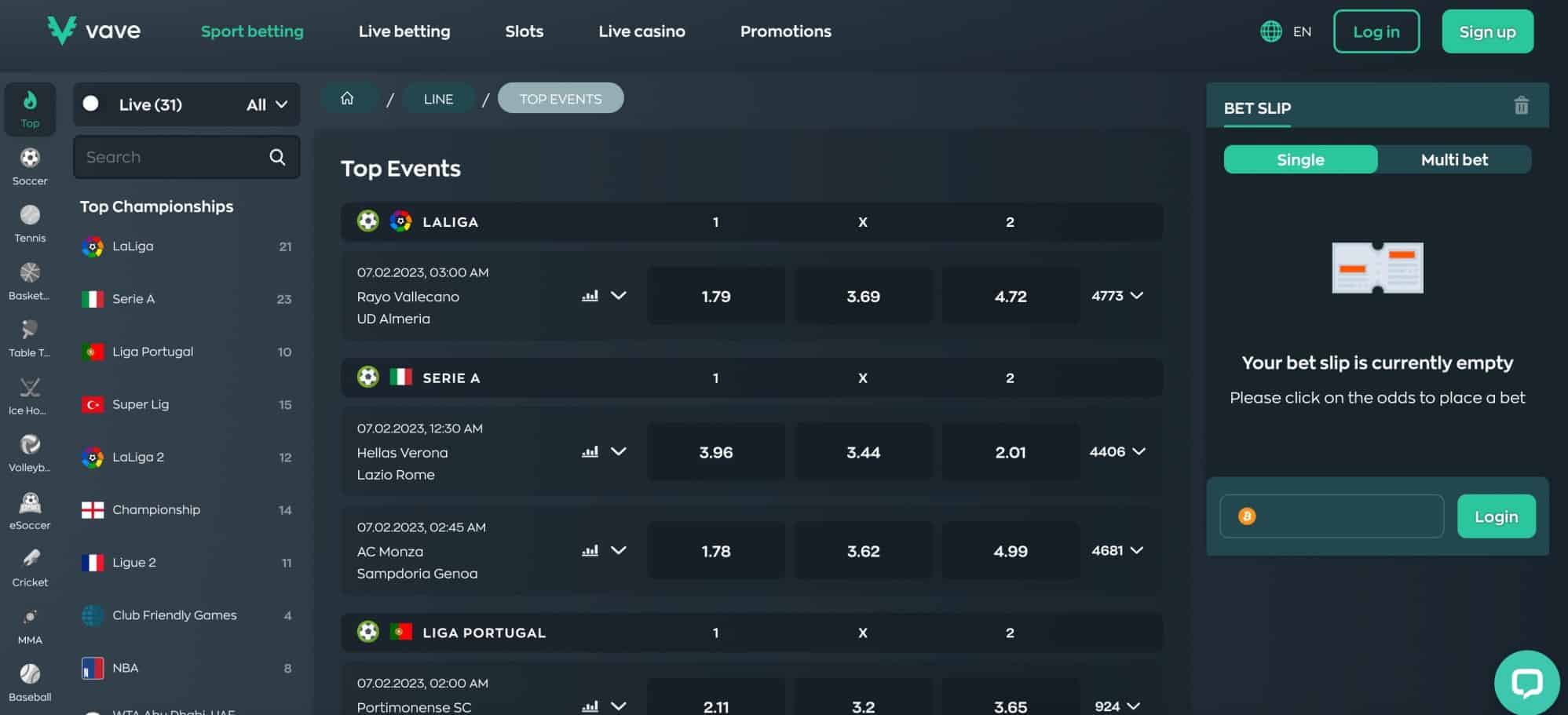

- VAVE – Rising Sportsbook And Casino With Over 35 Sports Available

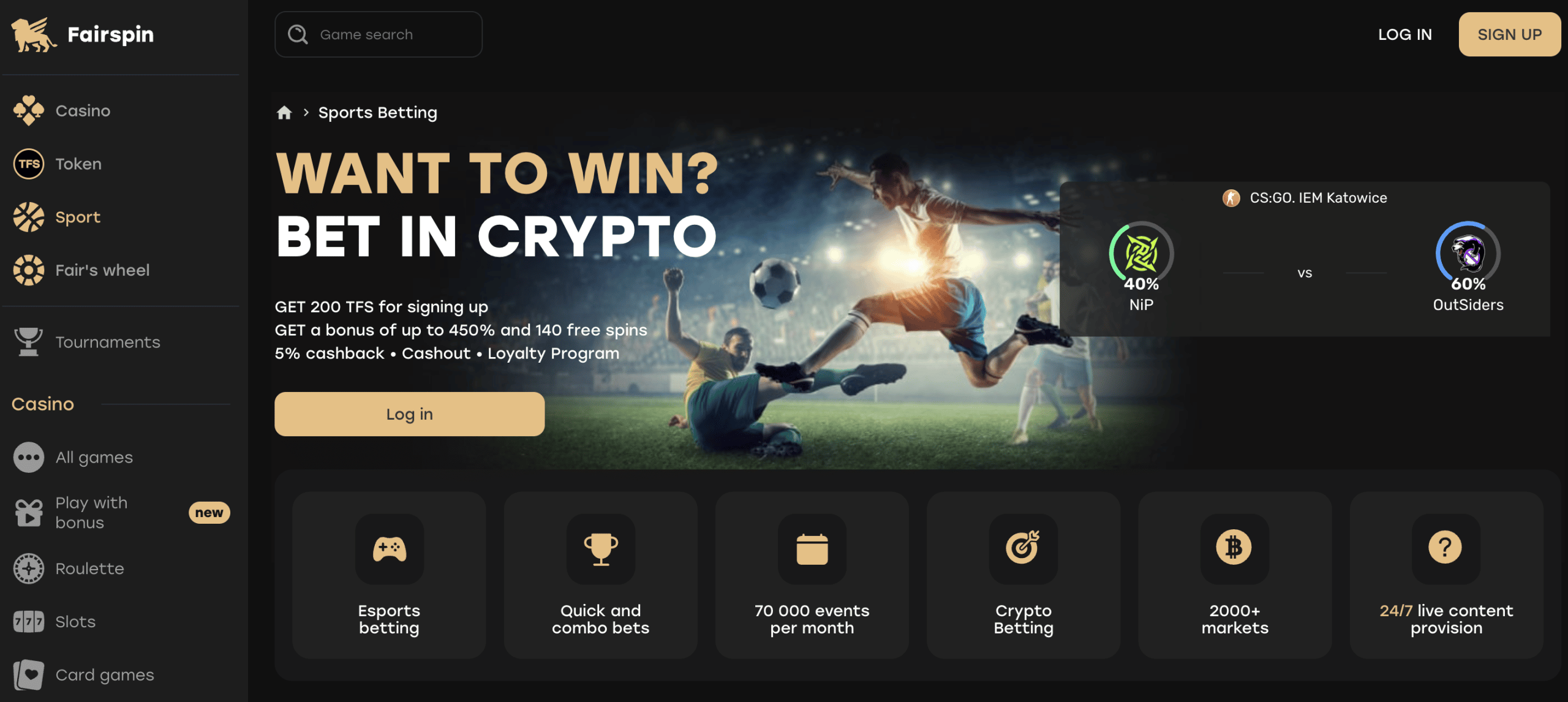

- Fairspin – 70,000+Monthly Bitcoin Sports Betting Markets

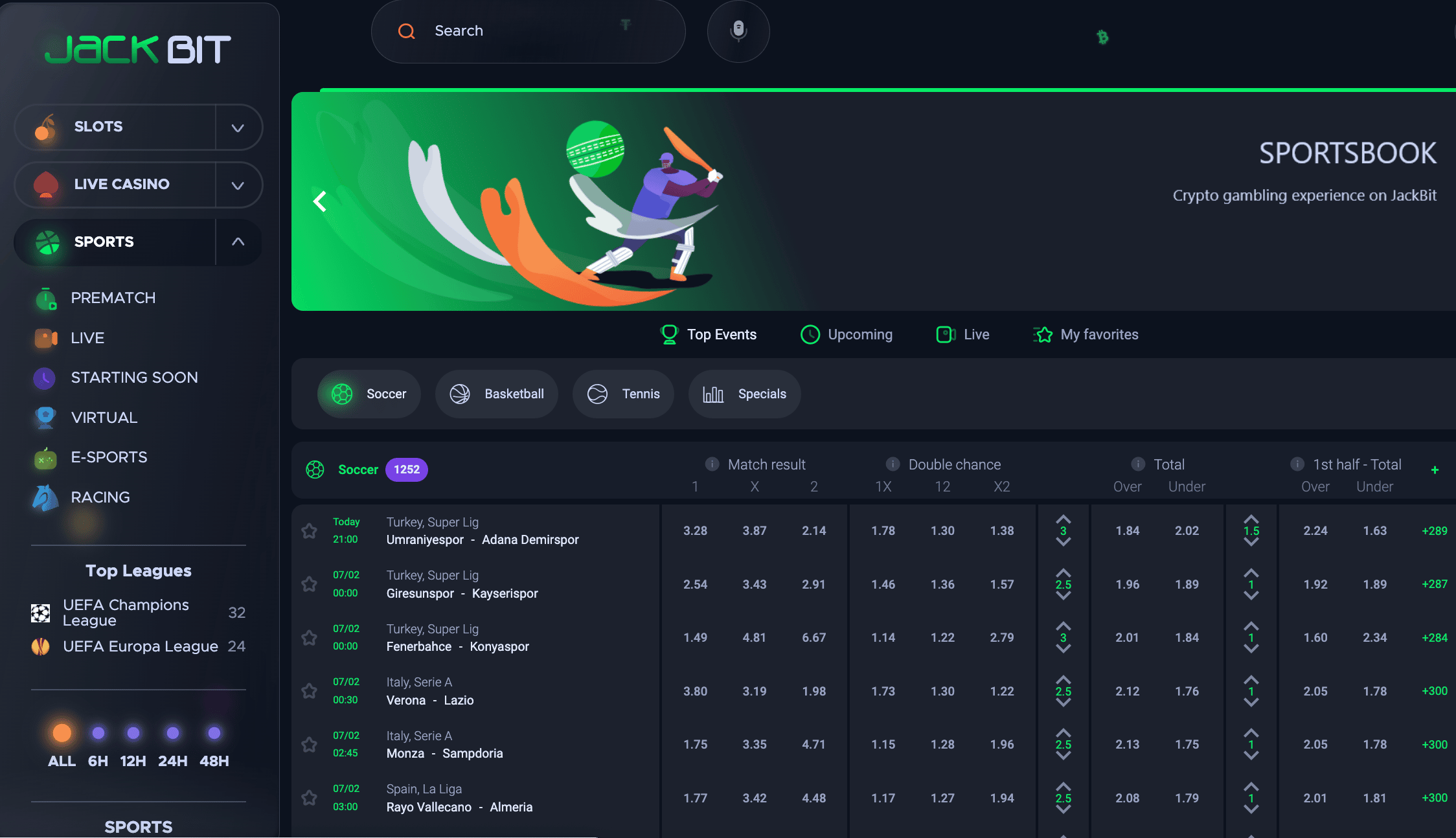

- Jackbit – 3+1 Bet Promotion Offered to All Sportsbook Players

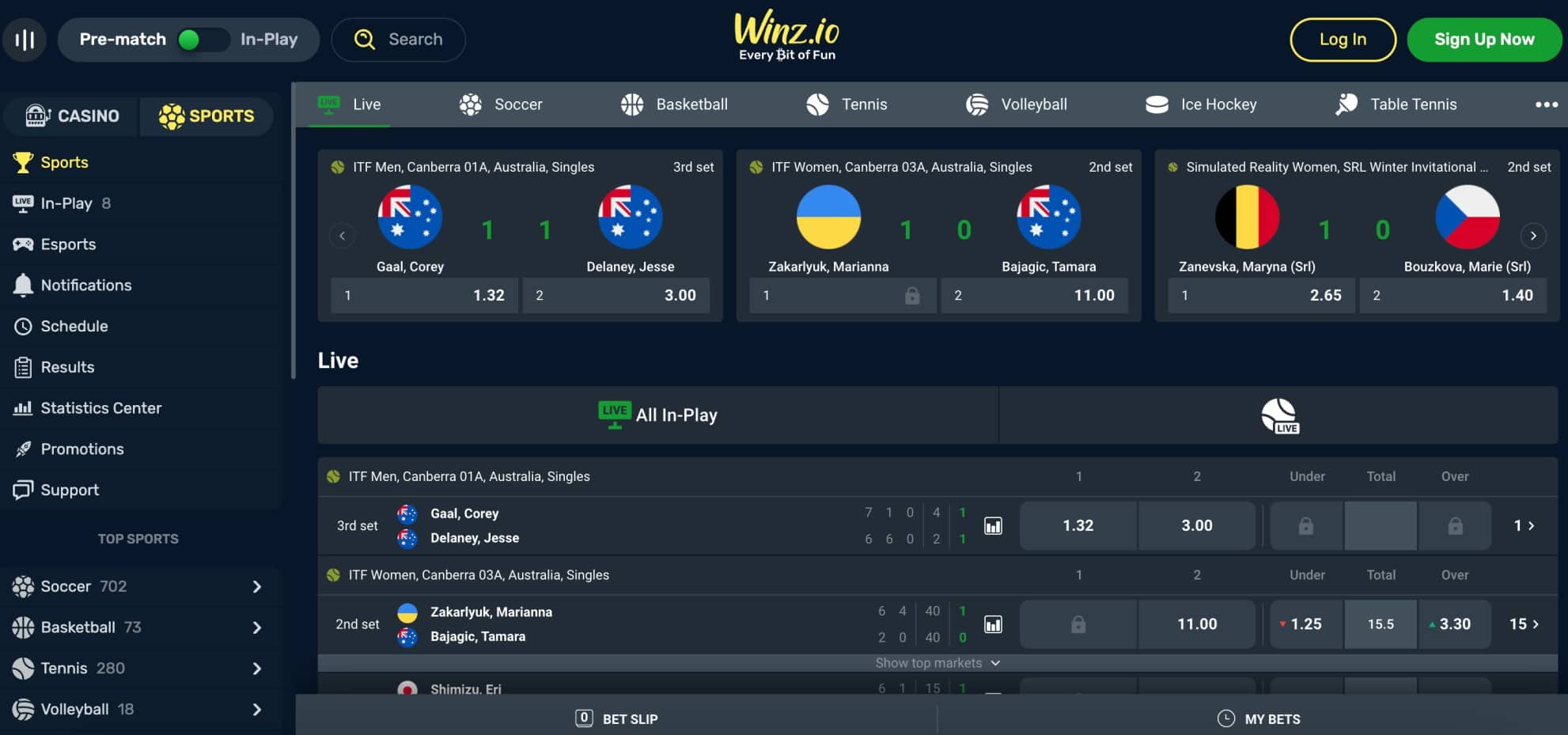

- Winz.io – Zero-Wagering Sportsbook Bonuses for New Players

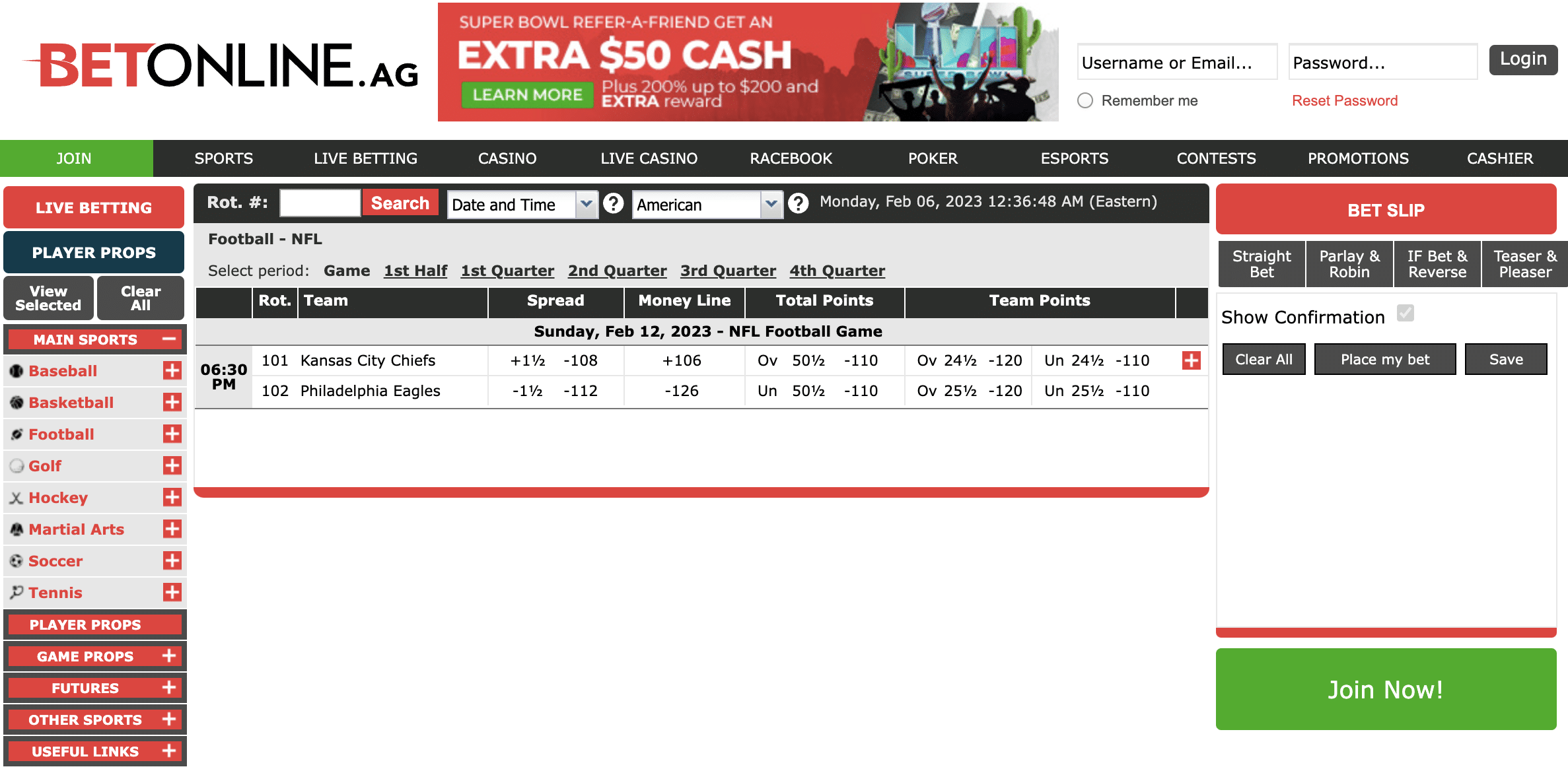

- BetOnline – Traditional Online Sportsbook That Now Supports Crypto

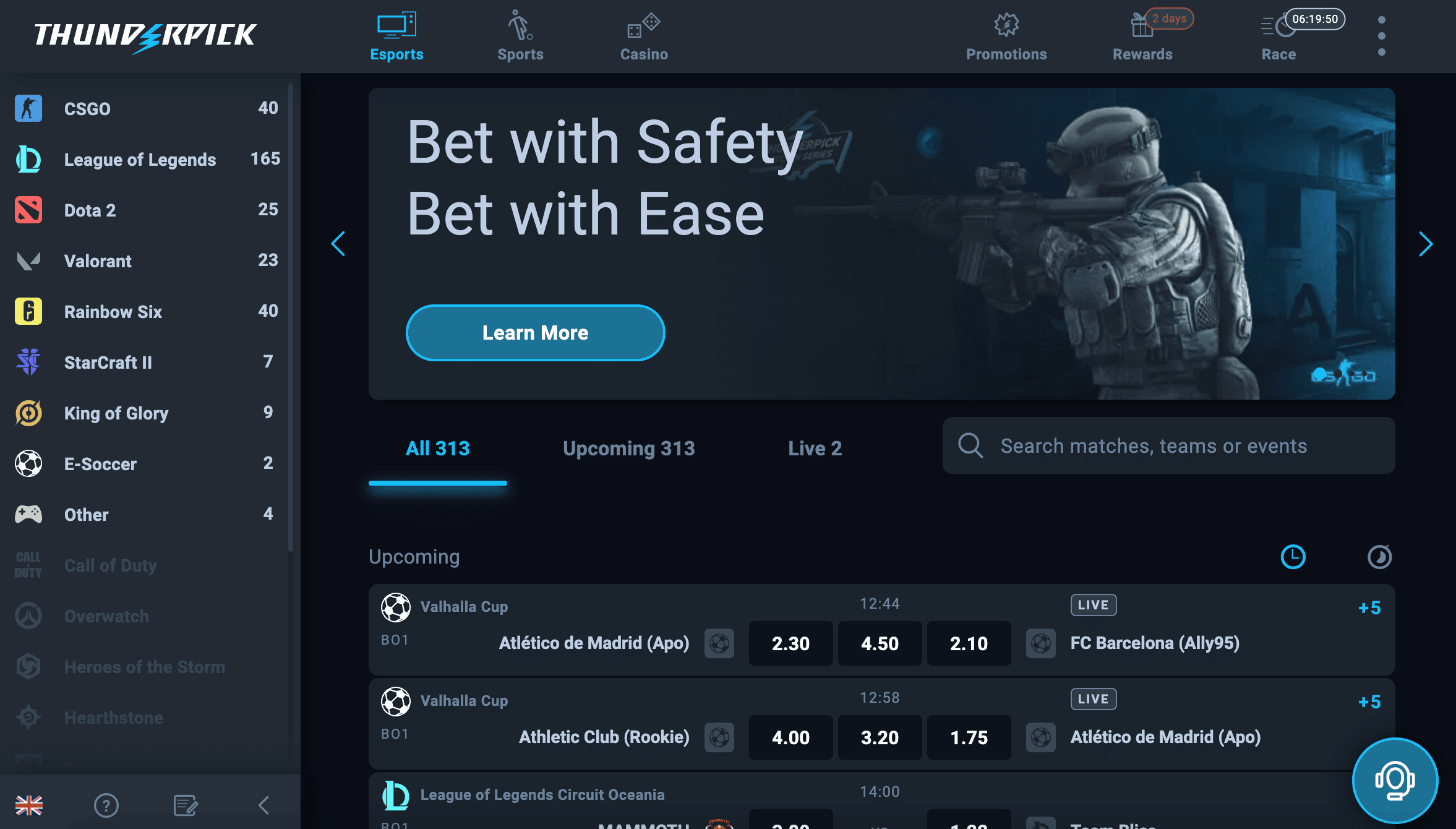

- Thunderpick – Top Sportsbook for Betting on Esports

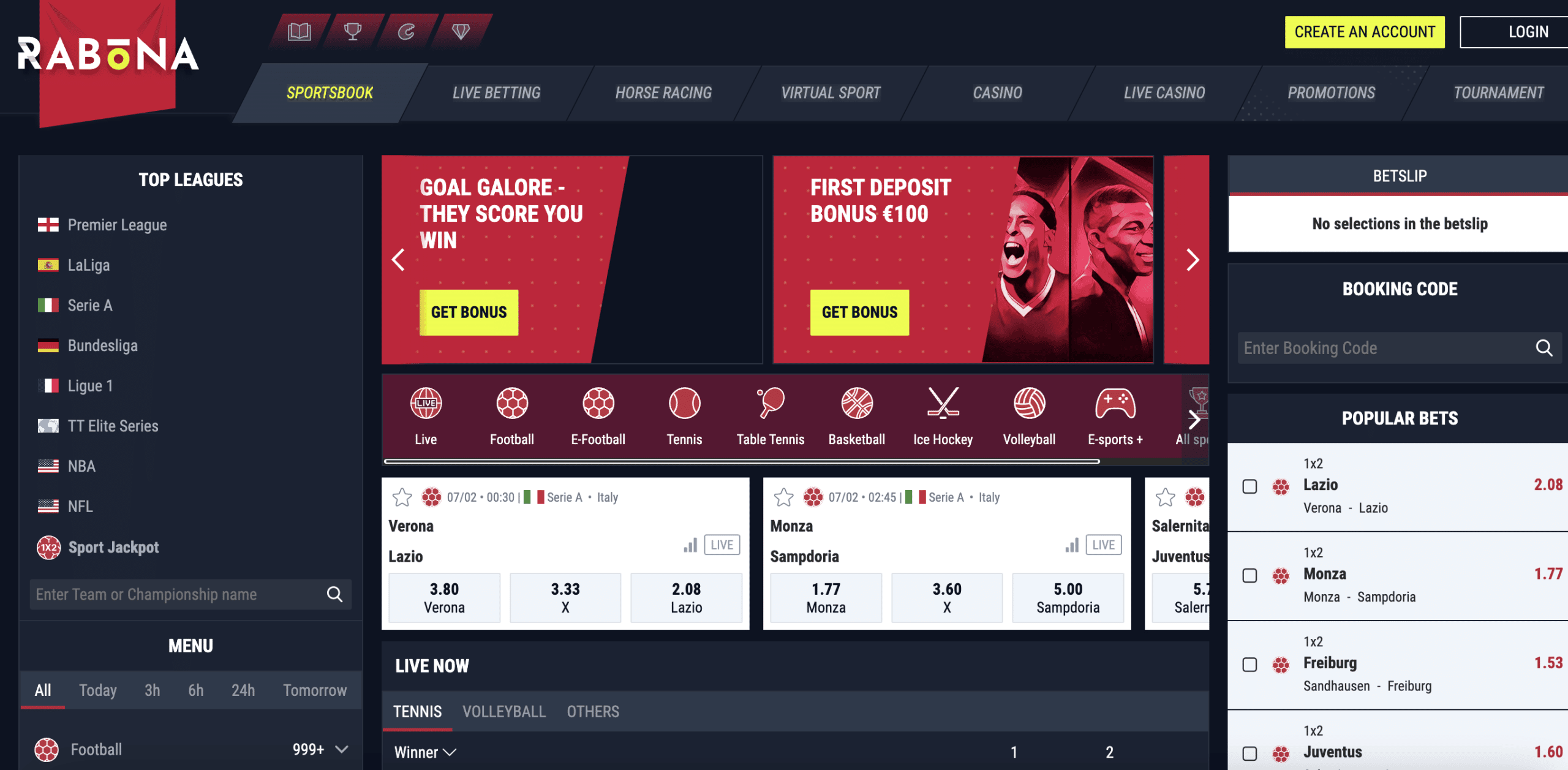

- Rabona – Generous Sportsbook Bonuses for Both New and Existing Players

Best Crypto Sports Betting Sites Reviewed for 2024

In order to rank the 10 best Bitcoin betting sites in the market, we followed a strict set of criteria that focused on a range of core requirements.

In addition to Bitcoin bonuses and promotions, we also gave priority to crypto sportsbooks with competitive odds, in-play markets, and fast payouts.

Read on to get started with the best Bitcoin sportsbook for 2024.

1. Lucky Block Sportsbook – Overall Best Bitcoin Betting Site 2024

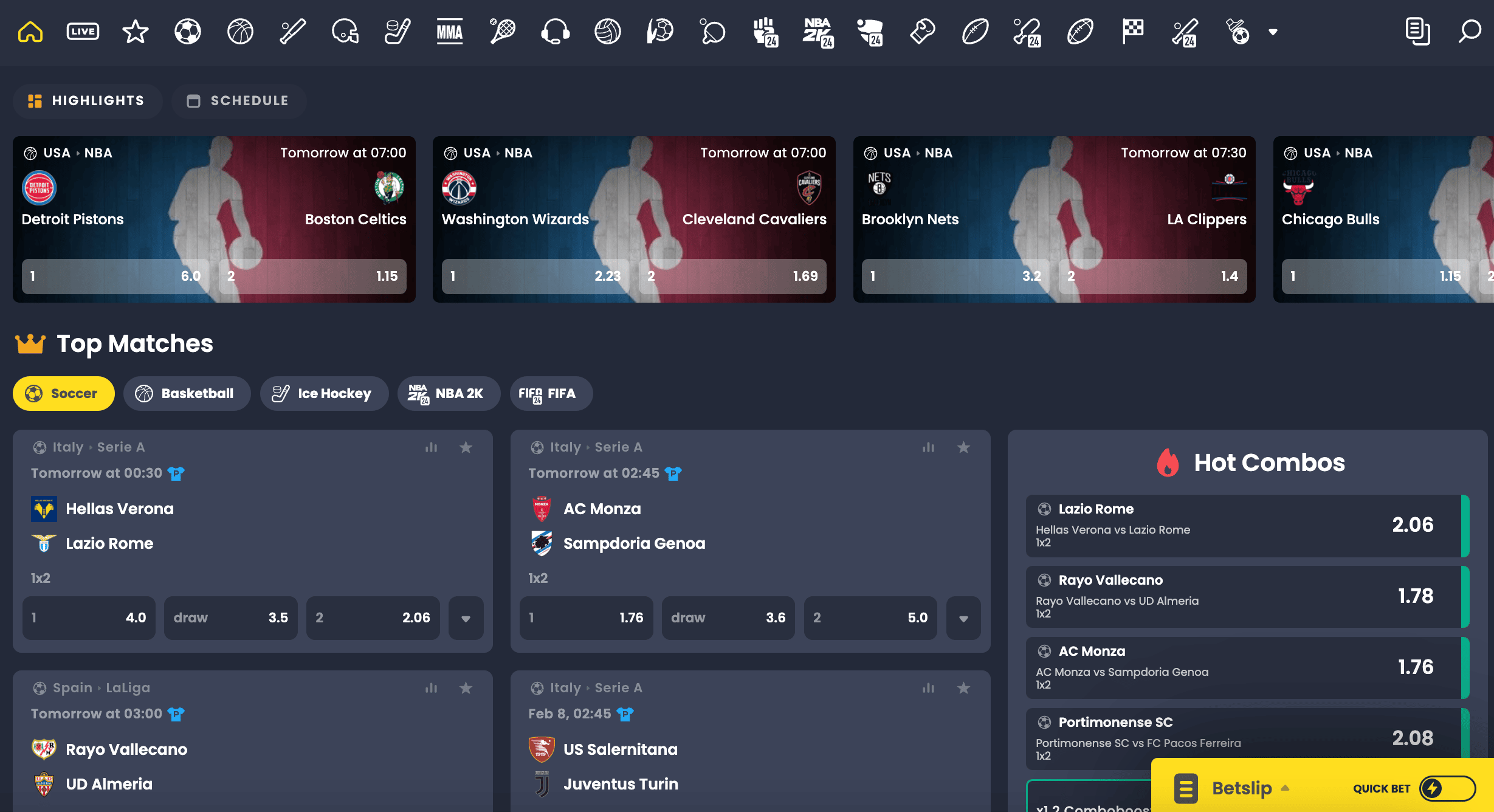

Lucky Block was a clear winner when we went through the process of ranking the best Bitcoin sportsbooks. We were impressed that it took just 30 seconds to get started with an account, not least because there is no traditional KYC process in place. Instead, we were only asked for an email address and a preferred username and password.

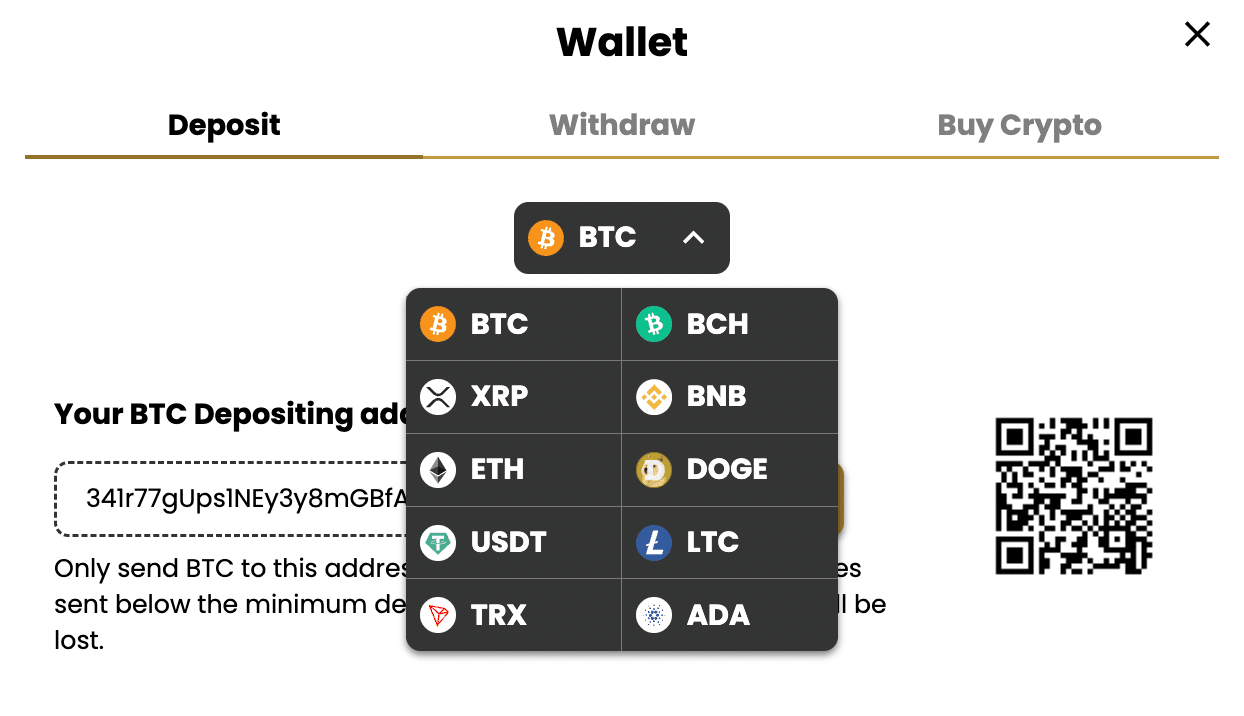

We also liked the payment process at Lucky Block, which facilitates a range of popular cryptocurrencies. In addition to Bitcoin, this includes BNB, XRP, Ethereum, Litecoin, Bitcoin Cash, Cardano, and others. Payments are processed quickly on a wallet-to-wallet basis, just like funding a cryptocurrency exchange account.

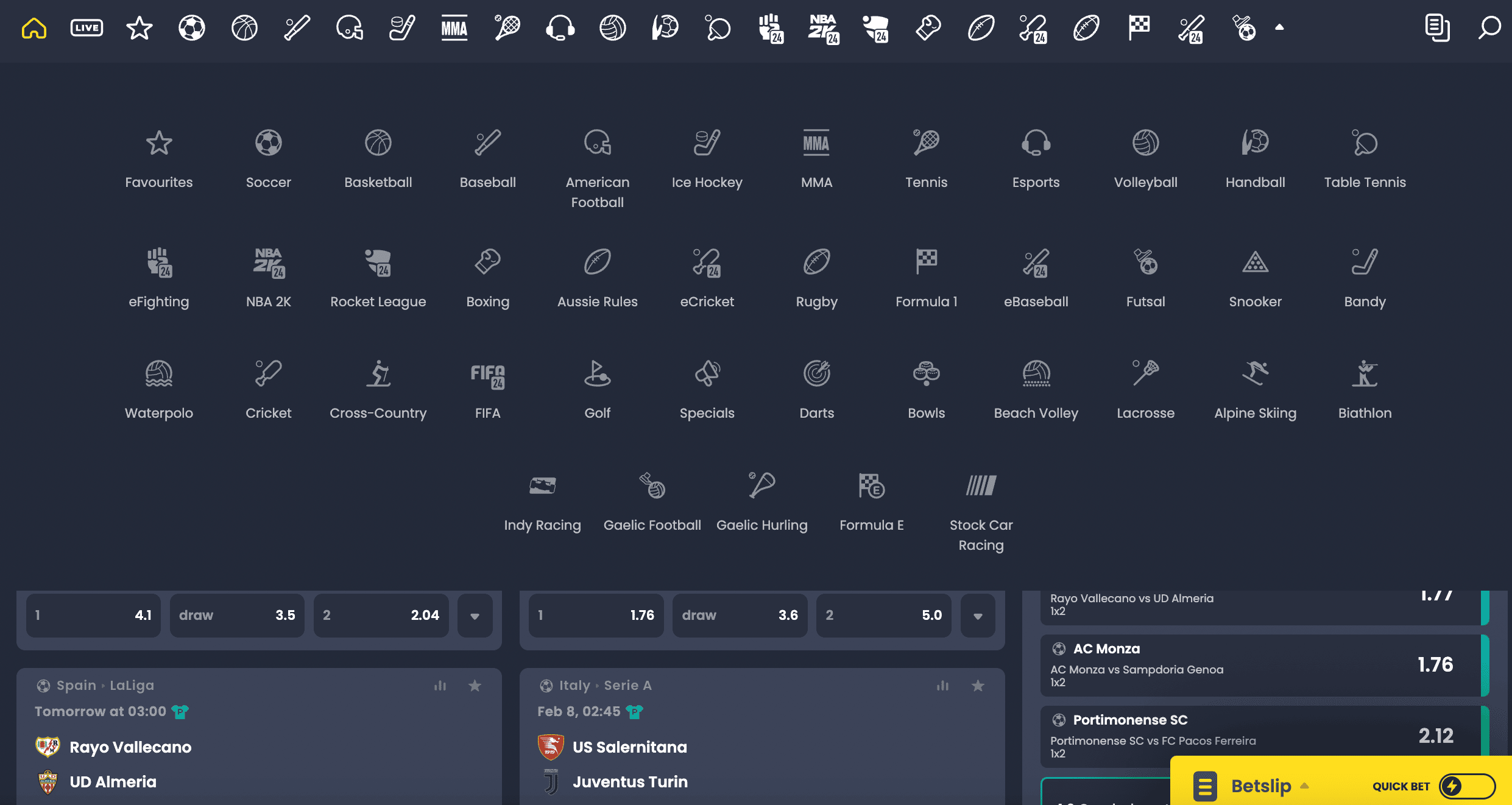

Once we were all set up at Lucky Block, we then begin exploring its vast sports betting platform. There are betting markets on every sport imaginable, from baseball, American football, and soccer to basketball, tennis, and rugby. Players can find a suitable betting market by choosing their preferred sporting event and reviewing the many wagering options on offer.

For instance, if betting on soccer, players can gamble on the outcome of the match, alongside handicaps, total goals, corners, yellow cards, goalscorers, and more. We compared the odds offered by Lucky Block with other sportsbooks and found the platform to be ultra-competitive. This is the case with both pre-match and in-play odds.

On top of being the overall best Bitcoin betting site, we found that Lucky Block is popular with casino fans. Lucky Block supports thousands of casino products from slots and table games to live dealers and video poker. We also ranked Lucky Block the best Bitcoin sportsbook for payouts, with the platform approving crypto withdrawals instantly.

| Welcome Bonus | No. of Sports | Live Betting | Accepted Cryptocurrencies | Crypto Bonus | Crypto Denomination | Minimum Deposit | Payout Time |

| 15% cashback on losses within the first seven days. VIP program for regular players. | 30+ | Yes | Bitcoin, Ethereum, Dogecoin, Bitcoin Cash, Tether, Litecoin, BNB, XRP, Cardano | Yes – see the main welcome package. | milliBitcoin | $1 | Instant |

Pros

- Overall best Bitcoin betting site

- Thousands of betting markets across more than 30+sports

- Industry-leading odds

- Minimum deposit of just $1

- Instant payouts

- 15% cashback promotion and VIP rewards

- Fully-fledged casino suite with 5,000+games

- No KYC policy on crypto-only accounts

Cons

- Bitcoin payouts are slightly slower than altcoins

2. BC.Game – Dual Crypto Sportsbook and Casino With 150+Coins Accepted

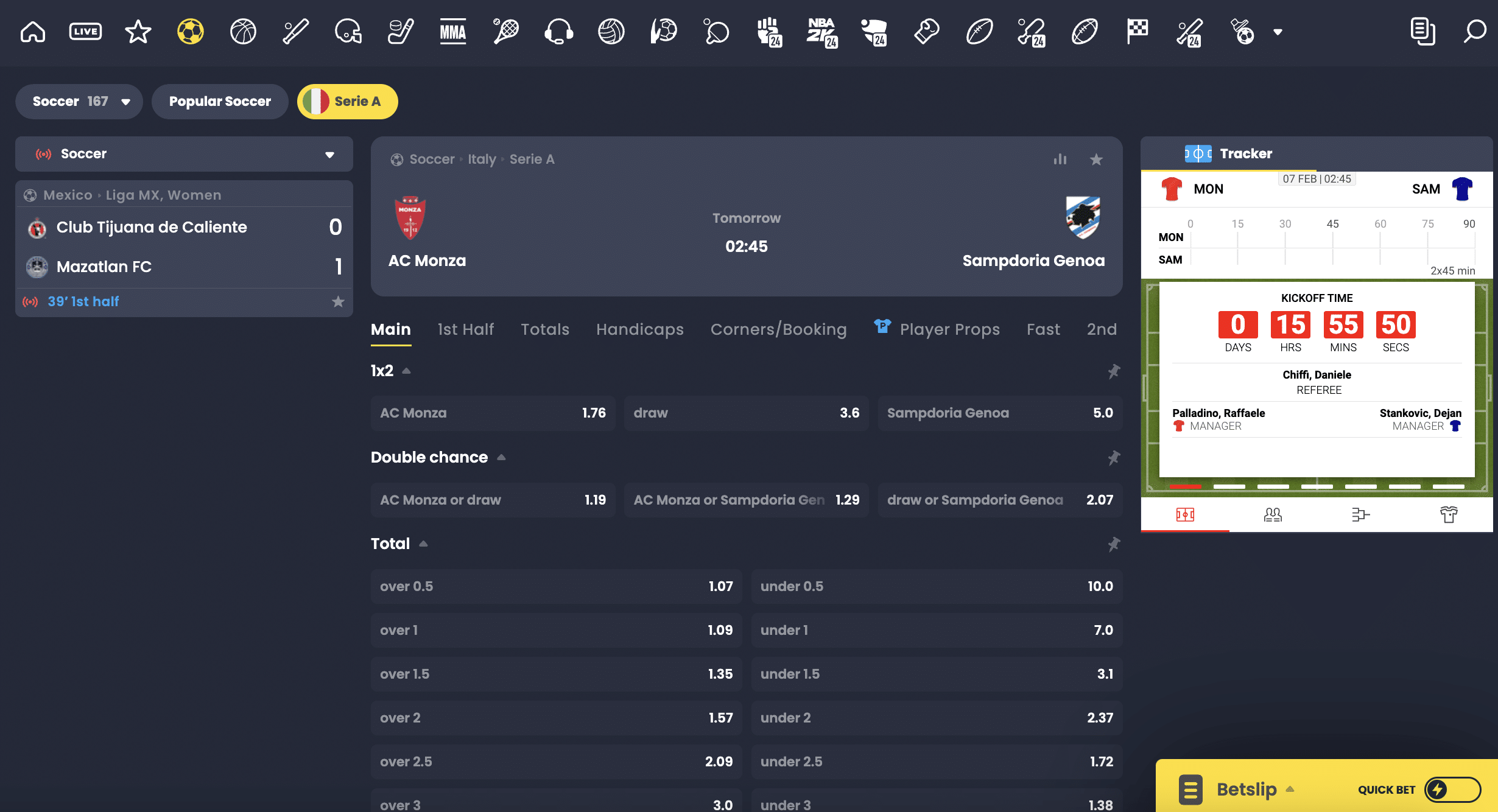

Players that are in the market for a dual gambling platform that supports both sports betting and casino games might also consider BC.Game. There is no KYC policy so all account types are anonymous. More than 150+altcoins in addition to Bitcoin are supported and in most cases, payouts are processed in under five minutes.

Dozens of sports are available to bet on at BC.Game. Across most days, there are thousands of betting markets to choose from both pre-match and in-play. Although not as competitive as Lucky Block, odds are still reasonable on the BC.Game sportsbook. We also found that BC.Game is suitable for both beginners and seasoned gamblers alike, considering its sleek interface.

For instance, players can find a betting market based on the sport, league, and timeframe. There is also a handy search box that enables players to find a specific match. In addition to its sportsbook, BC.Game is popular with casino players. Across thousands of games, this includes everything from blackjack, roulette, and dice to slots, video poker, and provably fair.

Another benefit of choosing BC.Game is that the platform offers generous bonuses and promotions. Those opening an account for the first time will be offered four deposit bonuses of between 280% and 360%. There are also random bonus code drops available via social media and email, not to mention a solid VIP program.

| Welcome Bonus | No. of Sports | Live Betting | Accepted Cryptocurrencies | Crypto Bonus | Crypto Denomination | Minimum Deposit | Payout Time |

| Four deposit bonuses of between 270% and 360%. VIP program plus random bonus drops. | 40+ | Yes | Bitcoin plus 150 altcoins. | Daily spin on the lucky wheel, plus task-related bonuses. | milliBitcoin | $30 | Usually within five minutes |

Pros

- 40+sports to bet on around the clock

- Competitive odds on most sporting events

- Four deposit bonuses for new player accounts

- Top-rated casino suite

Cons

- Higher minimum deposit than most other Bitcoin sportsbooks

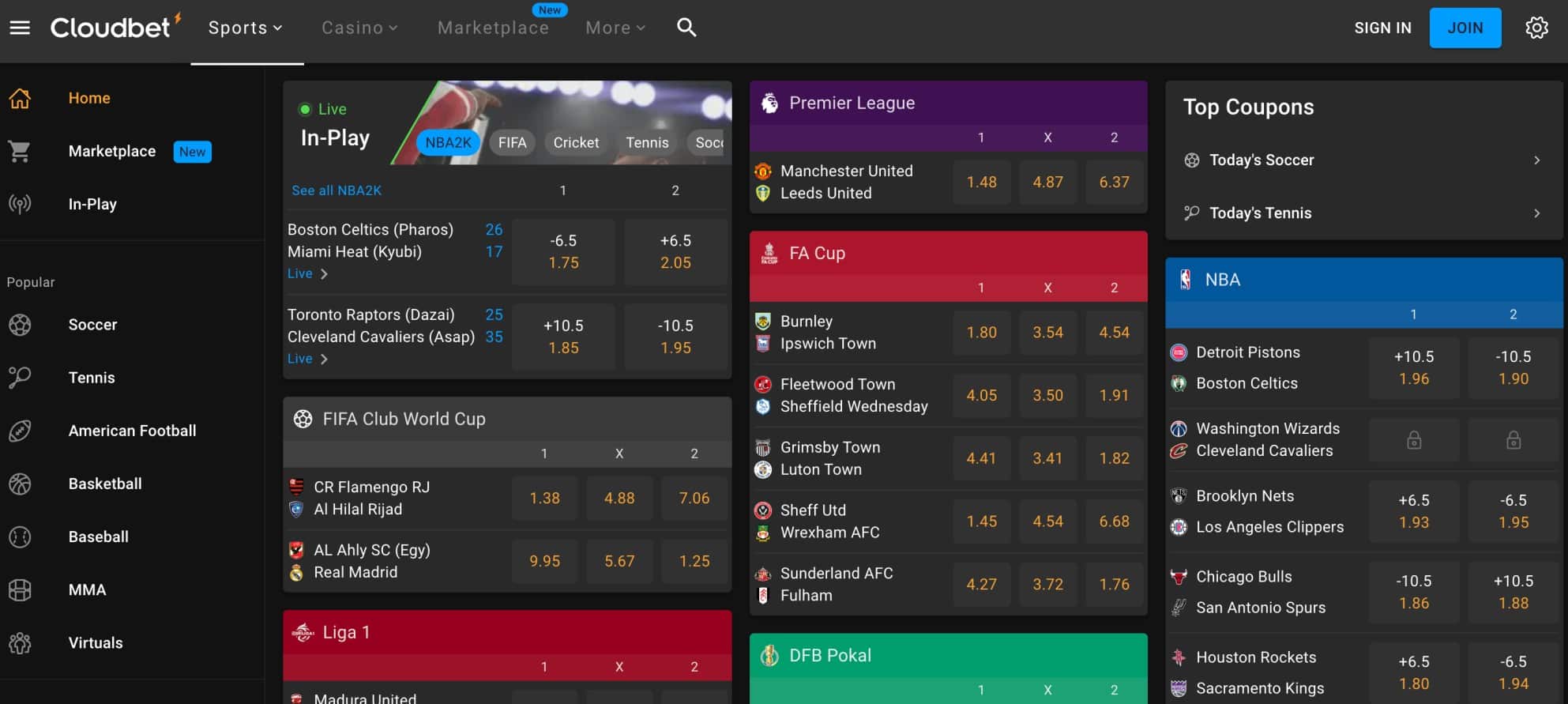

3. Cloudbet – One of the Original Bitcoin Sportsbooks to Enter the Market

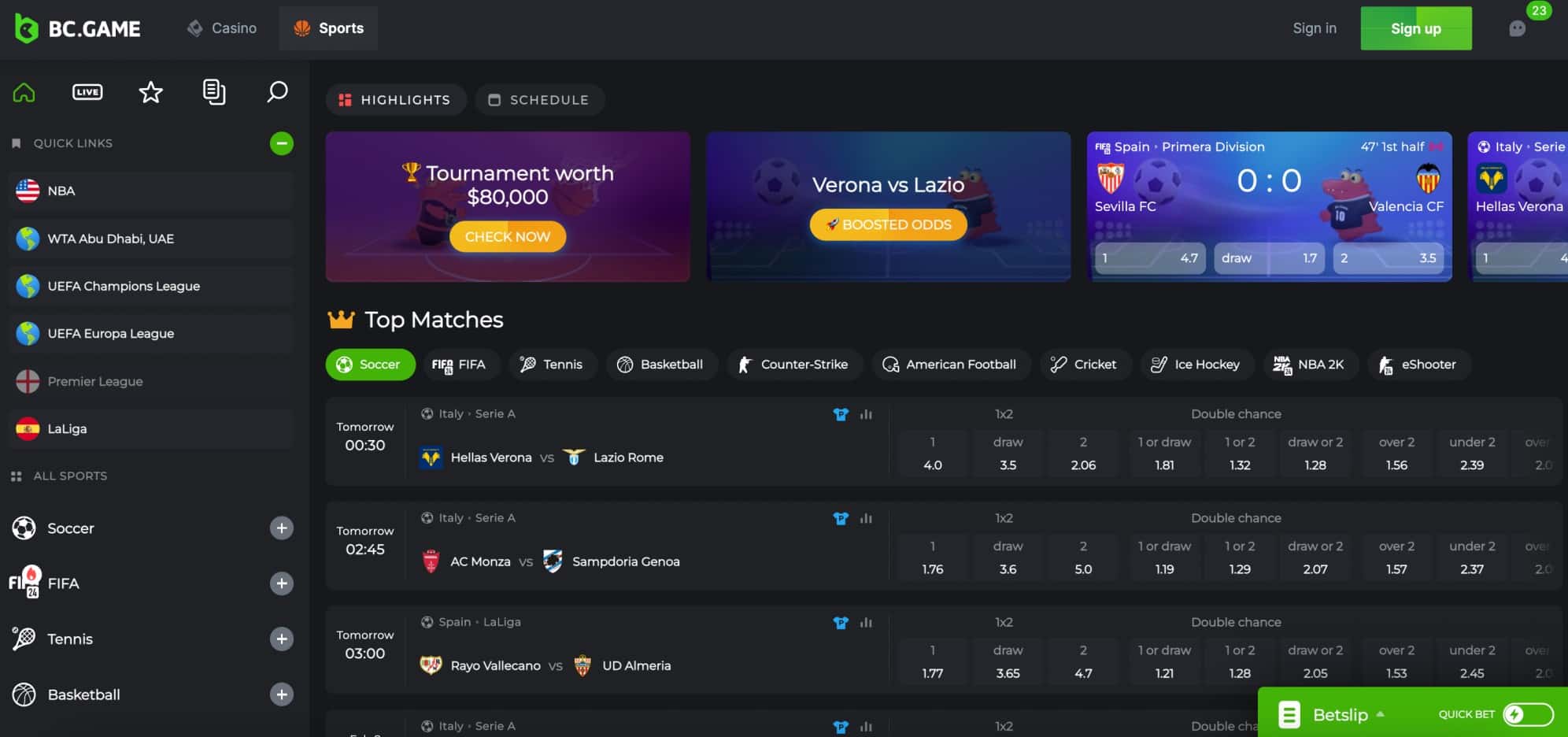

Players in the market for an established Bitcoin sportsbook might consider Cloudbet, which was first launched nearly a decade ago. Clooudbet – just like Lucky Block and BC.Game, covers a crypto sportsbook in addition to a fully-fledged casino suite. Both gambling divisions can be accessed from the same account – which does not require any KYC.

Cloudbet offers one of the most diverse sportsbooks in this space, with both pre-match and in-play markets offered across dozens of sports. Players can also access esports markets alongside virtual sporting events that operate 24/7. Odds are competitive at Cloudbet and players can choose their preferred format – from decimal, fractional, American, Hong Kong, and Malaysian.

We also like the loyalty program at Cloudbet, which rewards players with points every time a sportsbook bet is placed. Points can be converted into real-world prizes (such as a Rolex) and even bonuses, such as a free sports bet. While we are on the subject of bonuses, the welcome package at Cloudbet consists of a 100% matched deposit promotion.

The first deposit will be matched by up to 5 BTC, which values the bonus at over $100,000. The Cloudbet casino offers thousands of games, including but not limited to slots, dice, crypto crash, roulette, baccarat, and video poker. Plenty of altcoins are accepted in addition to Bitcoin and payouts are super-fast.

| Welcome Bonus | No. of Sports | Live Betting | Accepted Cryptocurrencies | Crypto Bonus | Crypto Denomination | Minimum Deposit | Payout Time |

| The first deposit is matched by 100% up to a maximum of 5 BTC. | 35 | Yes | Bitcoin, Ethereum, Bitcoin Cash, Tether, USD Coin, PAX, PAXG, Chainlink, DAI, Dash, Dogecoin, Litecoin | Earn points on every bet place – convert to prizes or bonuses. | milliBitcoin | 0.001 BTC | Usually within several minutes |

Pros

- Launched a decade ago

- One of the best Bitcoin sportsbook bonuses for new players

- Fast withdrawals

- Earn points on every sports bet placed

Cons

- Does not accept players from several countries – including the US, UK, and Australia

4. VAVE – Rising Sportsbook and Casino With Over 35 Sports Available

Next up on this list of the best Bitcoin betting sites is VAVE. By joining VAVE as a new player, there is a 100% matched deposit bonus of up to 1 BTC on offer. In order to get the bonus, a minimum deposit of 20 USDT (or equivalent) must be made and this will need to be wagered 10 times.

After VAVE credits the bonus, the player will need to wager it once before a withdrawal can be executed. The deposit and free bet must be wagered within 14 days and seven days, respectively. VAVE is home to a vast sportsbook with dozens of sports and thousands of markets, so there are plenty of opportunities to turn the bonus into withdrawable crypto.

VAVE supports both pre-match and in-play betting markets on a 24/7 basis. VAVE also offers a VIP program that comes with a maximum monthly free bet allocation of 10,000 USDT. Each sports bet is converted into compoints, which can be exchanged for bonuses and cashback. VAVE also offers classic casino games inclusive of live dealers.

| Welcome Bonus | No. of Sports | Live Betting | Accepted Cryptocurrencies | Crypto Bonus | Crypto Denomination | Minimum Deposit | Payout Time |

| The first deposit is matched by 100% up to a maximum of 1 BTC. | 35 | Yes | Bitcoin, Ethereum, Bitcoin Cash, Tether, Litecoin, XRP, Tron, and Dogecoin | Points-based loyalty program, plus weekly reload bonus of 50% every Thursday. | USDT | 20 USDT | From several minutes to 48 hours |

Pros

- 100% matched deposit bonus of up to 1 BTC

- 14 days to wager the original bonus

- Wagering requirements of just 10x

- Huge casino suite

Cons

- Most ongoing promotions are associated with casino games

5. Fairspin – 70,000+Monthly Bitcoin Sports Betting Markets

With more than 70,000 monthly betting markets supported, Fairspin is one of the best Bitcoin sportsbooks to consider today. In addition to competitive odds and a solid in-play betting facility, Fairspin is very generous when it comes to bonuses and promotions. The welcome package, for instance, consists of four deposit bonuses totaling 450%.

The welcome package also comes with up to 140 free slot spins. There is also a popular VIP program offered by Fairspin, with prizes increasing in size in line with the player’s wagering history. Initially, players will receive 5% weekly cashback with zero wagering requirements.

The top-tier rewards level offers 10% cashback per day, also without any wagering requirements. Fairspin also has its own native casino token – TFS. New players will get 200 free TFS tokens after joining, which can then be staked at an average APY of 535%. Like all of the best Bitcoin sports betting sites discussed so far, Fairspin also hosts a casino suite with live dealers.

| Welcome Bonus | No. of Sports | Live Betting | Accepted Cryptocurrencies | Crypto Bonus | Crypto Denomination | Minimum Deposit | Payout Time |

| The first four deposits are matched, totaling 450%. Plus 140 free slot spins. | Not stated, but 70,000+ monthly betting markets | Yes | Bitcoin, BNB, Bitcoin Cash, Cardano, Ethereum, NEO, Dogecoin, and many others. | 200 free TFS tokens plus a loyalty program | milliBitcoin | 0.001 BTC | Usually within 15 minute |

Pros

- Four deposit bonuses are offered to new players

- 70,000+monthly betting markets

- Top-rated in-play betting dashboard

- Popular for betting on esports

Cons

- 60x wagering requirement to withdraw the welcome bonus

6. Jackbit – Jackbit – 3+1 Bet Promotion Offered to All Sportsbook Players

Jackbit is a new entrant to the crypto gambling scene but is one of the best Bitcoin sportsbooks nonetheless. We like that Jackbit offers a wide range of sports betting markets that are accessible 24 hours per day. Players can find a suitable betting market by clicking on the ‘Upcoming’ button and then selecting the preferred sport.

Alternatively, players can head over to the ‘Live’ section to bet on sporting events that are already in play. Major sporting events typically come with 300+betting markets, which offers plenty of flexibility when choosing a suitable wager. Jackbit also supports esports markets and virtual sports around the clock.

The latter largely centers on soccer but also includes horse racing, basketball, and greyhounds. We also like Jackbit for its 3+1 free bet promotion, which is available to all players. This means that for every three sports wagers placed, a free bet will be credited. We were, however, disappointed to see that Jakcbit does not currently offer a traditional matched deposit bonus to new players.

| Welcome Bonus | No. of Sports | Live Betting | Accepted Cryptocurrencies | Crypto Bonus | Crypto Denomination | Minimum Deposit | Payout Time |

| No welcome bonus. | 40 | Yes | All cryptocurrencies supported by Changelly. | 1 free bet after every 3 sportsbook wagers. | Crypto balances converted to USD | $20 | Not stated |

Pros

- Huge selection of sports to bet on

- Free bet credited for every three wagers

- Supports any cryptocurrency listed on Changelly

- Fast deposits and withdrawals

Cons

- No matched deposit bonus for new players

7. Winz.io – Zero-Wagering Sportsbook Bonuses for New Players

Winz.io is home to a huge gambling suite that not only includes a Bitcoin sportsbook but casino games and live dealers. We like Winz.io for its sports welcome package – which comes without any wagering requirements. This means that, unlike other sport betting promotions, there is a great chance of turning the welcome bonus into withdrawable funds.

First and foremost, players will need to open a new account with Winz.io and enter the promotional code ‘SPORTS’. Next, by depositing at least $20 in crypto, the player will receive a 100% matched bonus of up to $500. By depositing at least $100, the player will also receive a $20 risk-free sports bet.

There are over 34 sports to bet on, including both pre-match and in-play. This includes everything from soccer and tennis to volleyball and basketball. Winz.io accounts can be opened without providing any personal information, so new players can get started in a matter of seconds.

| Welcome Bonus | No. of Sports | Live Betting | Accepted Cryptocurrencies | Crypto Bonus | Crypto Denomination | Minimum Deposit | Payout Time |

| 100% matched deposit bonus of up to $500. Plus a $20 risk-free bet. No wagering requirements. | 34 | Yes | Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Dogecoin, BNB, XRP, Tether | Free slot spins and 10% live casino cashback are also offered to new players. | milliBitcoin | 0.0008 BTC (to qualify for the welcome bonus) | Instant |

Pros

- Two sportsbook bonuses are offered to new players

- No wagering requirements on the welcome package

- 34 sports to bet on pre-match and in-play

- Ultra-fast withdrawals

Cons

- Matched deposit bonus is capped at $500

8. BetOnline – Traditional Online Sportsbook That Now Supports Crypto

We define BetOnline as a traditional online casino and sportsbook, considering that the platform was launched more than 25 years previous. This popular gambling provider has, however, since stepped into the world of crypto. Not only does it enable players to deposit and withdraw funds in Bitcoin, but plenty of altcoins too.

This includes Bitcoin Cash, Ethereum, XRP, Litecoin, Polygon, ApeCoin, and more. We like that the BetOnline sportsbook offers a traditional matched deposit bonus of 50% up to a maximum of $1,000. The wagering requirements on this bonus are very reasonable at just 10x. Moreover, BetOnline also offers crypto-specific bonuses.

For instance, the first crypto deposit made at BetOnline is matched by 100% up to $1,000. This comes with wagering requirements of just 14x but do note that the crypto bonus is only available to US and Canada-based players. BetOnline also offers live poker rooms, casino games, horse racing, and more.

| Welcome Bonus | No. of Sports | Live Betting | Accepted Cryptocurrencies | Crypto Bonus | Crypto Denomination | Minimum Deposit | Payout Time |

| 50% matched deposit bonus of up to $1,000. | 26 | Yes | Bitcoin, Bitcoin Cash, Ethereum, XRP, Litecoin, Polygon, ApeCoin, and more | 100% matched deposit bonus of up to $1,000 (US/Canadian clients only) | Crypto balances converted to USD | $20 | Up to 48 hours |

Pros

- 25+years in the online sportsbook industry

- Multiple sports betting bonuses offered

- Accepts US clients

- Casino games, live dealers, horse racing, and other gambling products

Cons

- Crypto-specific bonus only offered to US and Canadian clients

9. Thunderpick – Top Sportsbook for Betting on Esports

We found that Thunderpick is one of the best Bitcoin sportsbooks for betting on esports. The most popular esports games are supported here, such as Rainbow Six, Dota 2, CS:GO, and League of Legends, not to mention Valorant, King of Glory, and Call of Duty.

Players can gamble on esports games before the respective tournament begins, or via in-play odds. In addition to esports, Thunderpick also supports traditional sportsbook markets, such as soccer, tennis, American football, and baseball. New players can choose from one of two sportsbook bonuses when signing up.

While both bonuses are capped at €550, the wagering requirements will depend on the size of the matched deposit. For instance, wagering of just 2x is required when opting for a 5% deposit match. A 100% deposit match, on the other hand, comes with wagering of 30x. Thunderpick also offers a comprehensive casino suite.

| Welcome Bonus | No. of Sports | Live Betting | Accepted Cryptocurrencies | Crypto Bonus | Crypto Denomination | Minimum Deposit | Payout Time |

| Matched deposit bonus of up to €550. 100% or 5% match, with wagering of 30x or 2x. | 17 | Yes | Bitcoin, Ethereum, Tether, XRP, Bitcoin Cash, and Litecoin. | Regular reload bonuses, monthly tournaments, and a VIP program. | milliBitcoin | $20 | Up to 25 hours, but usually much faster |

Pros

- Two deposit bonuses to choose from

- Regular promotions for existing players

- One of the best Bitcoin betting sites for esports

- Great VIP program

Cons

- Withdrawals can take up to 25 hours (but usually much faster)

10. Rabona – Generous Sportsbook Bonuses for Both New and Existing Players

Rabona offers a beginner-friendly sports betting platform that also doubles up as a comprehensive casino suite. One of the best features of Rabona is that it offers a huge range of bonuses for both new and existing players. Those without an account will be offered a 100% matched deposit bonus of up to €100.

Although the bonus amount is small, the wagering requirement is just 1x. Moreover, players can bet on any sporting event as long as the odds are at 1.50 or above. After claiming the welcome package, players can then move on to the weekly reload bonus of 50%, capped at €500. Once again, the wagering requirement is just 1x.

There is also a 10% accumulator boost and a 50% deposit bonus to be used on horse racing. Other bonuses include boosted odds on major games and refunds when certain conditions are triggered, such as a 0-0 draw in soccer. We also like that Rabona offers a native mobile app for iOS and Android, in addition to desktop software for both Mac OS and Windows.

| Welcome Bonus | No. of Sports | Live Betting | Accepted Cryptocurrencies | Crypto Bonus | Crypto Denomination | Minimum Deposit | Payout Time |

| 100% matched deposit bonus of up to €100, with 1x wagering requirements. | 35 | Yes | Bitcoin, Ethereum, Litecoin, Tether, USD Coin, XRP, Bitcoin Cash, and Dogecoin | 50% weekly reload bonus of up to €500. Plenty of other weekly bonuses. | Crypto balances converted to EUR | €10 | 1-3 days |

Pros

- 100% matched deposit bonus with 1x wagering

- Wide selection of weekly promotions

- Beginner-friendly sportsbook and casino

- Mobile app for iOS and Android

Cons

- Withdrawals take 1-3 days to process

How to Choose the Best Bitcoin Sportsbook

We ranked 10 of the best Bitcoin betting sites from many dozens of providers that are operational in this industry.

Here’s how we ranked the Bitcoin sportsbooks that we researched:

- Crypto Payments: We initially explored the payments department, in terms of supported cryptocurrencies and the safety of deposits.

- Sign-Up Process: The best Bitcoin sportsbooks offer a fast and seamless sign-up process. At Lucky Block, accounts can be opened in just 30 seconds as there is no cumbersome KYC process to meet.

- Sporting Events: We only consider Bitcoin betting sites that offer a wide range of sports. In addition to conventional sports like tennis, soccer, and baseball, we also look for platforms that support esports and horse racing.

- Available Markets: Top Bitcoin sportsbooks offer a huge selection of betting markets to choose from. This should be the case both pre-match and in-play.

- Odds: The best Bitcoin sportsbook that we came across – Lucky Block, offers some of the most competitive odds in this industry. This is an important consideration to make when selecting a provider.

- Bonuses: All of the Bitcoin sports betting sites discussed today offer a range of bonuses for new and/or existing players. This includes free bets, cashback, matched deposits, VIP rewards, and more.

- Payouts: We only consider crypto betting sites that facilitate ultra-fast payouts. The likes of Lucky Block, BC.Game, and Cloudbet generally approve payout requests instantly.

Benefits of Online Crypto Sports Betting

There are many benefits of choosing a crypto sportsbook over a platform that specializes exclusively in fiat currency.

Such as:

Anonymous Betting

The best crypto betting sites offer anonymous accounts – meaning no KYC steps are required to get started.

This means that players can bet on sports without revealing their identity, not to mention upload proof of ID and residency.

Much Faster Withdrawals

We also found that when compared to fiat-centric platforms, the best crypto betting sites offer ultra-fast withdrawals.

No longer do players need to wait 48 hours and more to receive their winnings with platforms like Lucky Block and BC.Game offering near-instant cashouts.

More Competitive Odds

With less red tape to follow, the best crypto betting sites spend less on regulatory demands and more on player benefits.

One such example of this is that in many cases, crypto betting sites offer more competitive odds on sporting events.

Huge Bonuses and Incentives

Leading on from the above section, the best crypto betting site providers have the ability to offer much more generous bonuses to new players. For example, Cloudbet offers a 100% matched deposit bonus of up to 5 BTC – which is worth over $100,000.

What Crypto Coins Can You Bet with?

The list of cryptocurrencies supported by Bitcoin sportsbooks will vary from one platform to the next.

We found that the main digital assets that players can gamble with are those listed below:

- Bitcoin – The most commonly used cryptocurrency when gambling on sports online is Bitcoin. Most providers credit deposits after one confirmation, which means about 10 minutes.

- Ethereum – All of the Bitcoin sportsbooks discussed today accept Ethereum. Payments are much faster but oftentimes, fees can be high.

- Dogecoin – The popular meme coin Dogecoin is supported by Lucky Block, BC.Game, Cloudbet, VAVE, and many of the other top-rated crypto sportsbooks listed on this page.

- Litecoin – Just like Dogecoin, Litecoin is also accepted at many crypto casinos. Litecoin is faster than Bitcoin, not to mention cheaper to send and receive.

- Bitcoin Cash – Many online gamblers will deposit funds in Bitcoin Cash, considering that payments are executed quickly.

In addition to the above, the best crypto sportsbook for 2024 – Lucky Block, also supports BNB, XRP, Cardano, Tether, and other altcoins.

What Sports Can You Bet on at Bitcoin Sportsbooks Online?

The best crypto sportsbooks in the market will support dozens of popular sports – ranging from soccer, baseball, rugby, and American football to tennis, basketball, and cricket.

Many crypto betting sites support esports too, with popular events including games like Dota 2 and League of Legends.

Some platforms also enable players to gamble on horse racing and virtual sports. Ultimately, in terms of supported betting markets, both crypto and fiat sportsbooks are very similar in this regard.

Best Bitcoin Sports Betting Bonuses & Promo Codes

We will now discuss some of the best Bitcoin sports betting bonuses available to players in 2024.

Free Bets

Free bets are popular with sports bettors, as they essentially offer a risk-free way to gamble on sporting events.

For example:

- Jackbit offers a free bet for every three sports-related wagers.

- Winz.io offers a $20 risk-free bet when players make their first deposit of $100 or more.

- Rabona offers free bets on almost a daily basis, many of which are related to soccer.

Most free bets will need to be wagered before a withdrawal can be made, albeit this isn’t always the case – such as with the Winz.io risk-free promotion.

Matched Deposits

Matched deposit bonuses are even more common than free bets.

For example:

- BC.Game offers four deposit bonuses of between 270% and 360% to new players

- Cloudbet offers one deposit bonus of up to 5 BTC, with the first payment being matched by 100%

- VAVE offers a 100% matched deposit bonus of up to 1 BTC

Just like free bets, matched deposit bonuses will need to be wagered before a cashout request can be made.

No Deposit Free Bets

On rarer occasions, a Bitcoin sportsbook might offer a no deposit bonus in the form of free bets. So far in 2024, no such bonuses are being offered by leading Bitcoin sportsbooks.

VIP Rewards

The best Bitcoin betting sites discussed today offer a VIP program. Lucky Block offers high rollers a range of perks, such as free bonuses. Essentially, the more than is wagered, the more lucrative the rewards.

Best Bitcoin Betting Bonuses 2024

Here’s an overview of the best Bitcoin betting site bonuses for 2024:

| Welcome Package | Wagering | Promo Code | |

| Lucky Block Sportsbook | 15% cashback on losses within the first seven days. VIP program for regular players. | None | None |

| BC.Game | Four deposit bonuses of between 270% and 360%. VIP program plus random bonus drops. | Wager amount x 1% x 20% = Unlock amount | None |

| Cloudbet | The first deposit is matched by 100% up to a maximum of 5 BTC. | Welcome Bonus Points = Converted Stake x 0.008 x (100-RTP) | None |

| VAVE | The first deposit is matched by 100% up to a maximum of 1 BTC. | 10x | None |

| Fairspin | The first four deposits are matched, totaling 450%. Plus 140 free slot spins. | 60x | None |

| Jackbit | No welcome package | N/A | N/A |

| Winz.io | 100% matched deposit bonus of up to $500. Plus a $20 risk-free bet. | None | SPORTS |

| BetOnline | 50% matched deposit bonus of up to $1,000. | 10x | BOL1000 |

| Thunderpick | Matched deposit bonus of up to €550. | 100% or 5% match, with wagering of 30x or 2x. | WELCOME (for 5% match only) |

| Rabona | 100% matched deposit bonus of up to €100 | 1x | None |

Is Crypto Sports Betting Legal?

Technically, sports betting with crypto is neither legal nor prohibited in the vast majority of countries. This is on the proviso that deposits and withdrawals are made specifically in crypto assets rather than fiat money.

In some countries, gambling is prohibited in its entirety. With that said, many crypto-only sportsbooks operate a ‘No KYC’ policy. This means that the account holder will not be asked for their country of residence, let alone their name or address.

Mobile Bitcoin Betting Apps

Some Bitcoin sports betting sites offer a mobile app for iOS and Android. BC.Game and Rabona are two such examples. If a native app isn’t offered by the sportsbook, then the provider will have likely optimized their platform for mobile web browsers.

Lucky Block, for example, can be accessed via a smartphone, simply by logging in through its website. Both the Lucky Block sportsbook and casino suite offer a seamless mobile gambling experience.

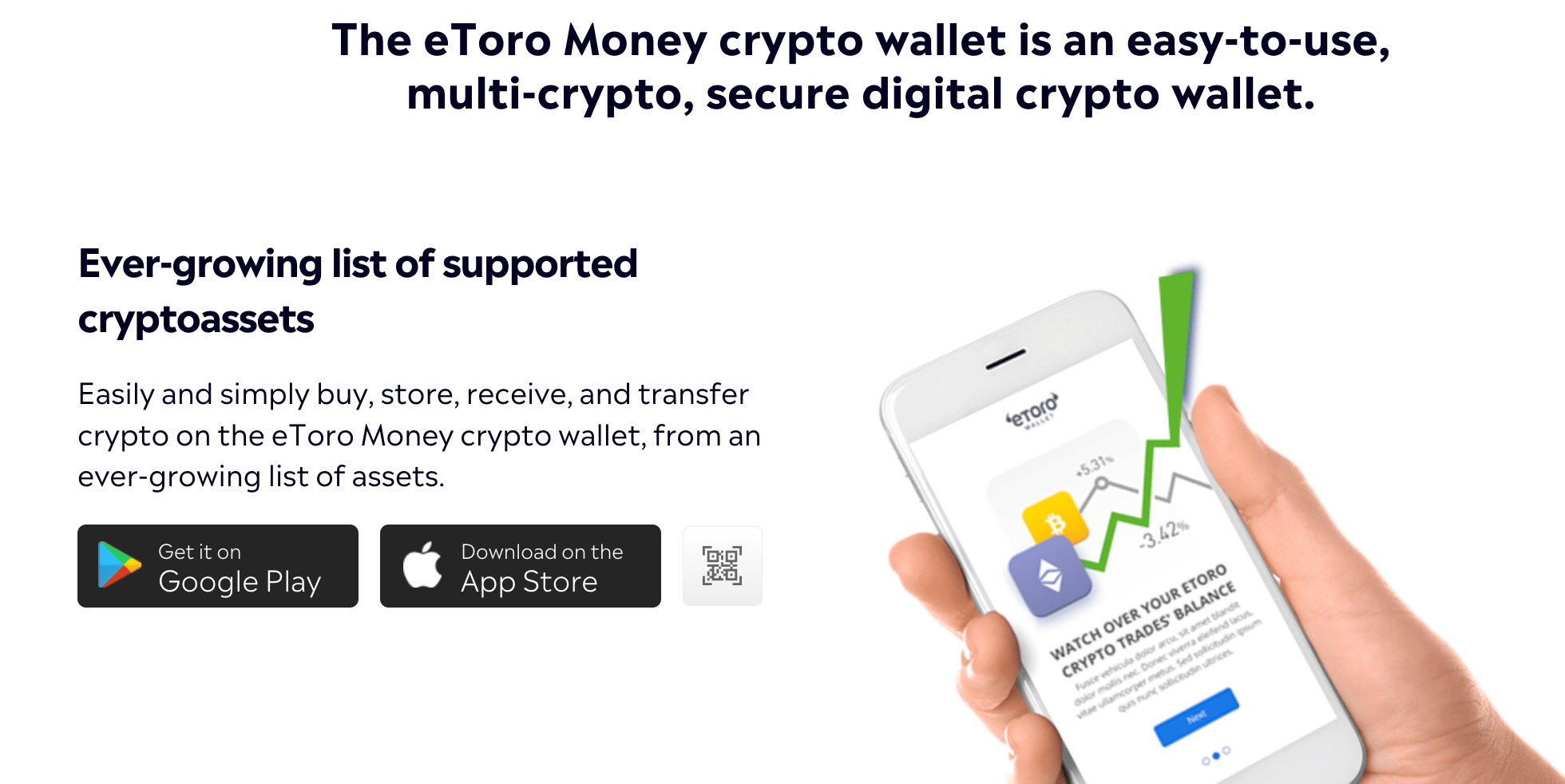

What is the Best Crypto Wallet for Sports Betting?

Looking for a crypto wallet that is compatible with leading Bitcoin sportsbooks?

If so, we found that eToro is the overall best option for both newbies and experienced gamblers alike.

Read on to find out why.

eToro – Best Bitcoin Wallet for Sports Betting

Not only does eToro offer the best Bitcoin wallet for sports betting, but it is also the most suitable broker to buy cryptocurrency. eToro is regulated by multiple licensing bodies, including the SEC and FCA. As such, the broker is safe to use. eToro supports more than 70 cryptocurrencies, all of which can be purchased from just $10.

We also like that eToro offers competitive fees, with a 1% charge payable on both buy and sell positions. In addition to its low-cost and regulated framework, we like that eToro offers a mobile wallet that can be downloaded via an Android or iOS mobile app. This enables players to deposit and withdraw funds to and from their preferred Bitcoin sportsbook.

Both incoming and outgoing transactions are processed quickly when using the eToro wallet, so there will be no waiting around like other providers that came across. eToro also supports other asset classes, such as stocks, ETFs, commodities, indices, and forex. Moreover, eToro offers copy trading tools alongside smart portfolios.

Both of these products enable users to invest in cryptocurrencies and other assets passively. We also like that eToro supports debit/credit cards and e-wallets for making instant payments. There is a small FX fee of 0.5% to deposit fiat money, but this is waivered when the payment is made in US dollars.

How to Place a Sports Bet With Bitcoin

Placing a sports bet with Bitcoin or any other cryptocurrency for that matter is a process that takes just five minutes from start to finish when using Lucky Block.

The reason for this is that Lucky Block does not request any personal information when opening an account and deposits are processed near-instantly.

Here’s how to place a Bitcoin sports bet with Lucky Block:

Step 1: Join Lucky Block

Visit the Lucky Block website and open an account by entering an email address.

New players will also need to choose a password and a username.

Step 2: Deposit Crypto

Click on ‘Deposit’ and choose a cryptocurrency to add to the Lucky Block account. The depositing address will then be displayed.

Copy it and transfer the cryptocurrencies from a private wallet.

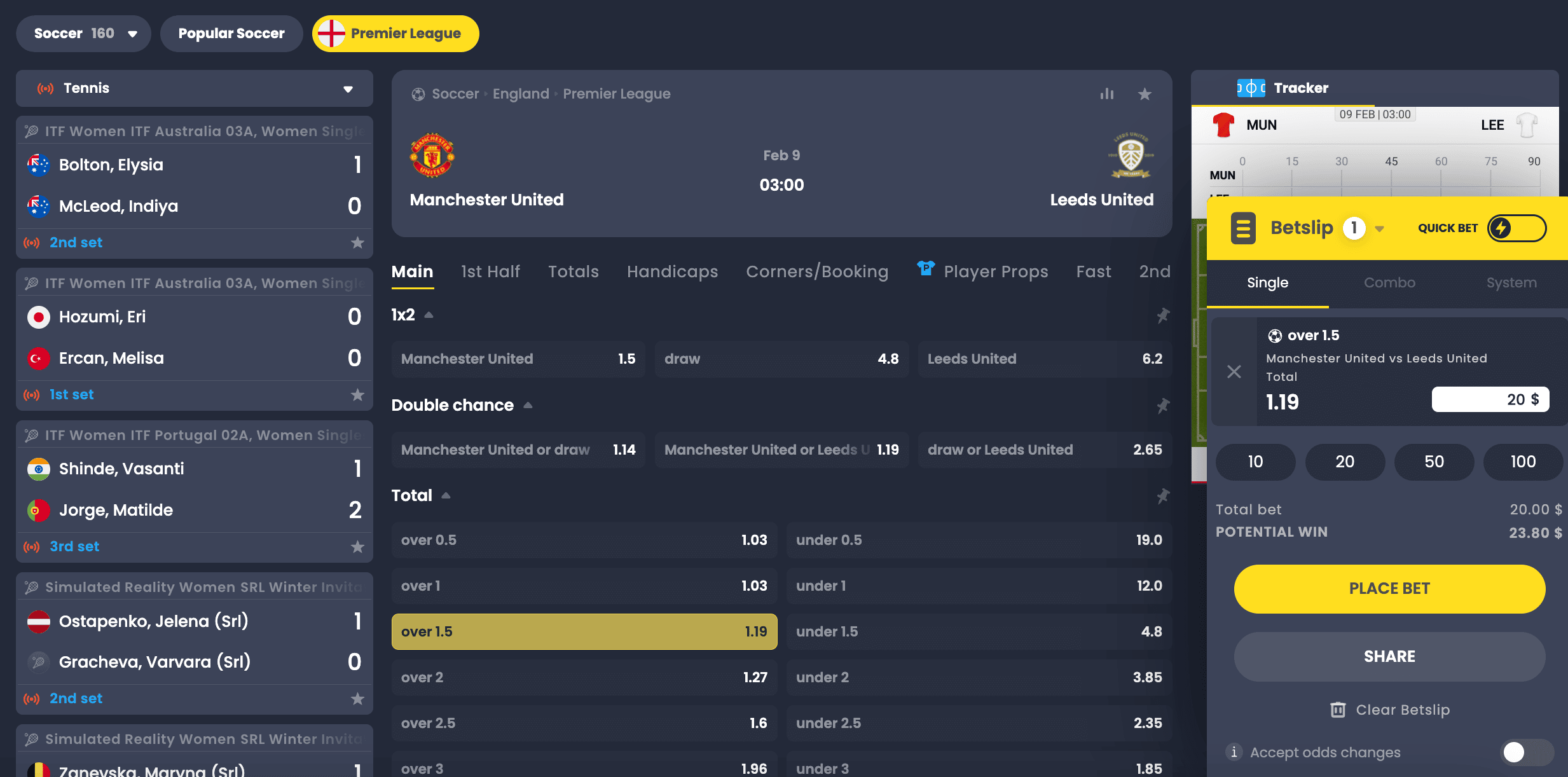

Step 3: Choose a Sporting Event

Once the deposit has been processed, the player’s account balance will automatically update accordingly.

To proceed, click on the ‘Sports’ button. Next, select a sport to bet on, such as soccer or baseball. Lucky Block will then display a list of upcoming sporting events that currently have odds.

Step 4: Place Sports Bet

After choosing a game, the next step is to select an individual betting market.

In our example, we are betting on there being more than 1.5 goals in the Manchester United vs Leeds game.

The betting slip will ask for the total stake. Finally, click on ‘Place Bet’ to confirm the sports wager.

Winning bets are settled near-instantly at Lucky Block.

Conclusion

This comprehensive guide has offered some of the 10 best Bitcoin betting sites. We have ranked our list of providers based on bonuses, supported betting markets, odds, withdrawal speeds, and much more.

Lucky Block is perhaps the overall best option in this crowded space, considering it offers industry-leading odds across thousands of monthly betting markets.

We also like Lucky Block for its near-instant deposits and withdrawals, not to mention that accounts can be opened in just 30 seconds (No KYC).

FAQs

Can you use Bitcoin to bet on sports?

Yes, betting on sports with Bitcoin (and other crypto assets) has never been easier. First, you will need to open an account with a Bitcoin sportsbook like Lucky Block, before making a deposit with BTC from your wallet. Then you will have access to thousands of betting markets at leading odds.

What is the best anonymous Bitcoin sportsbook?

Lucky Block is the best Bitcoin betting site for gambling anonymously. Deposits and withdrawals are near-instant and odds are industry-leading.

Why bet with crypto?

When betting on sports with crypto, some providers (like Lucky Block and BC.Game) enable you to open an account anonymously. Betting with crypto also facilitates super-fast deposits and withdrawals, plus generous welcome bonuses for new players.