It was believed that South Africa’s second-largest supermarket chain, Pick n Pay, would start accepting bitcoin in one of its stores. However, a fresh report indicates that that is not the case.

On the 18th September, payments software development firm Electrum made the announcement. It said that it had enabled Pick n Pay to accept bitcoin payments in store. For a limited time, it was reported that customers at Pick n Pay’s head office store have been able to use the digital currency to buy groceries and services. During the check-out process, customers simple scanned the QR code through a bitcoin wallet app on the customer’s smartphone. The bitcoin infrastructure for the project was provided by South Africa-based Luno, a global bitcoin company.

Jason Peisl, an executive at Pick n Pay, said:

“Cryptocurrency and bitcoin are still relatively new payment concepts, yet we have been able to effectively demonstrate how we are able to accept such alternative payments.”

It’s thought that the goal was to determine what customers’ of Pick n Pay feel regarding the use of a digital currency. The next step then would be to start accepting the cryptocurrency across all its store locations in South Africa.

Electrum MD Dave Glass, added:

“We’ve worked closely with PnP for several years as a key technology provider. Our mission is to support innovative enterprises like Pick n Pay, and together we use the advanced Electrum software-as-a-service technology to move quickly on new opportunities, whilst at the same time delivering the best possible shopping experience.”

Regulatory Framework Needed

Yet despite claims that Pick n Pay is accepting bitcoin, it appears that isn’t the case.

In a separate report, the supermarket chain said it was ‘unlikely to roll out the solution‘ without an established regulatory framework in place.

Richard van Rensburg, Pick n Pay deputy CEO, explained that the test had been limited to their canteen store at the head office and was no longer active.

He said:

“We don’t expect that in the near term accepting bitcoin will unlock any significant new business and we are unlikely to roll out the solution until the payments industry and regulatory authorities have established a framework for managing the risks associated with cryptocurrencies. We have proved to ourselves, though, that it is technically possible to roll out a solution very quickly.”

He added that digital currencies were still in ‘relative infancy.’ As a result, it would take time for them to be accepted as a form of payment.

Rensburg said:

“Progress is unlikely to be hampered by technology but rather by regulatory issues and concerns.”

South Africa’s Central Bank Tests Digital Currency Regulations

In July, the South Africa Reserve Bank (SARB) revealed that it was to begin testing cryptocurrency regulations. For many authorities, regulation is the way forward.

Consequently, SARB has been in discussions with Bankymoon, a blockchain-based solutions provider. SARB has chosen Bankymoon for its first sandbox business to conduct an experiment with digital currency regulations.

At the time, Loerien Gamaroff, CEO of Bankymoon, said the two are working together to determine a future relationship.

He said:

“This is because the Reserve Bank is very hesitant to give a stamp of approval on anything that comes out. The sandbox will only be bitcoin focused during this initial phase, but is focused on applying broad regulations to all cryptocurrencies.”

Such a move, however, will give a formal foundation and deliver legitimacy to bitcoin that people will trust.

Gamaroff added:

“I think the regulation will move things along and make people on the street comfortable with bitcoin. With these new regulations, these everyday people can now trust that bitcoin is not just for hackers and criminals.”

‘Too Risky’ to Issue Digital Currency

However, despite South Africa’s interest in cryptocurrencies it doesn’t feel now is the right time to embrace it.

As a result, the deputy governor of SARB has said that it’s ‘too risky‘ to start issuing its own digital currency.

In August, Francois Groepe, the deputy governor of SARB, said:

“Virtual currencies have the potential of becoming widely adopted. However, for the central bank to issue virtual currencies or cryptocurrencies in an open system will be too risky for us. This is something that we really need to think about.”

Yet, the bank is still interested in exploring the technology. Consequently, SARB has established a three-man team to research cryptocurrencies. It’s hoped that, eventually, the central bank will be able to provide a clearer picture as to where the market stands.

Until then supermarket chains such as Pick n Pay are unlikely to start accepting bitcoin for grocery payments.

Central Banks Can’t Ignore the Crypto Market

A recent report has said that world central banks can no longer turn a blind eye to the digital currency market. According to the Bank for International Settlements (BIS), central banks need to look at them closely as they could pose a risk to financial security.

This report comes at a time when the market has experienced a tough week. China’s crackdown on initial coin offerings (ICOs) and domestic digital currency exchanges has impacted market prices. Several prominent crypto exchanges have already announced that they will be suspending their services. BTCC and ViaBTC will halt operations at the end of September. Whereas, OKCoin and Huobi are expected to stop operating by the end of October.

Additionally, Jamie Dimon, CEO of JPMorgan Chase, hasn’t helped things by calling bitcoin a fraud.

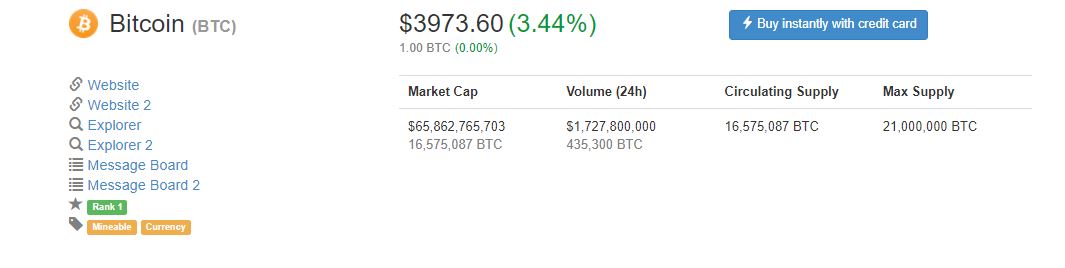

Yet, despite these setbacks in the market, prices have rallied back. At the time of publishing, on the 19th September, bitcoin is trading at $3,973. Over a 24-hour period it has increased its value by 3.44 percent. However, in seven days its remains down by 7.08 percent. Its market cap it worth $65.8 billion.

This is a marked improvement from when it was trading below $3,000 on the 15th September. Trading at $2,947, its market cap was worth $48.8 billion. The fact that the market is climbing again indicates that governments aren’t having much of an impact on the industry as initially thought. China and others may try to stamp out the sector, but it doesn’t appear to be going anywhere. This is good news for the community who are keen for bitcoin to continue to gain prominence. Only time will tell what will happen next.

Featured image from Shutterstock.